TUNISIA/ GABON: Panoro Energy Provides Operational Update

Operational Highlights

Group net production of 2,117 bopd for Q3 2020, down slightly on Q2 due to announced pump replacements during the quarter in Tunisia

Production and lifting operations maintained and largely unaffected through the crisis

Health and Safety systems and protocols proved resilient

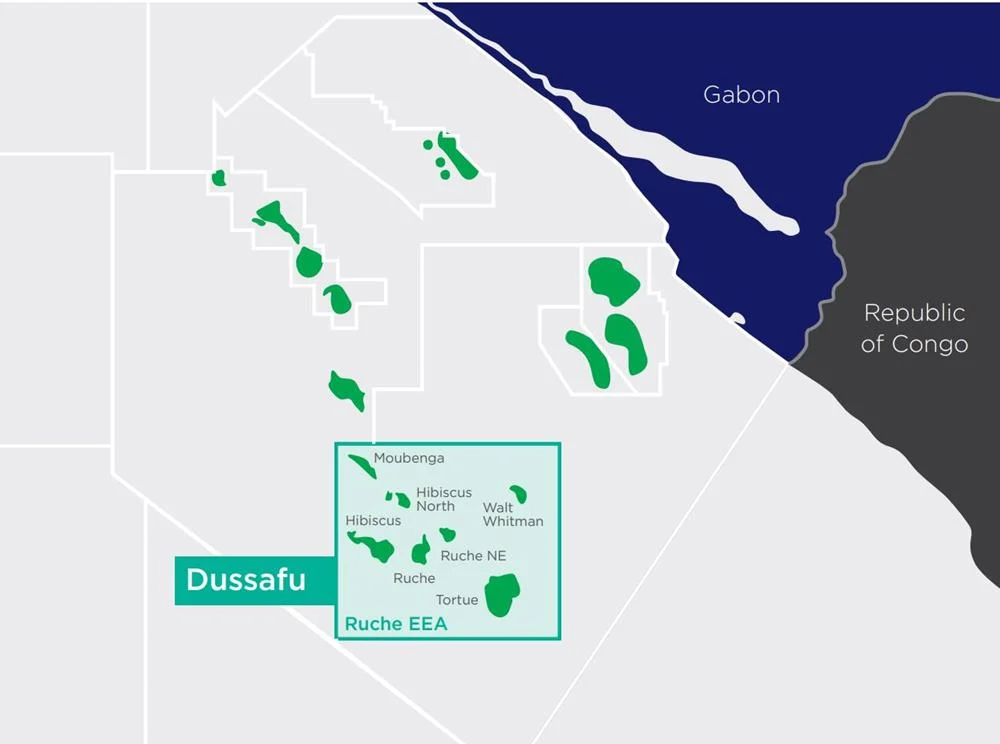

Gabon

In Gabon, quarterly production of 15,449 bopd gross on average, slightly below last quarter’s record high, with peak production levels exceeding 20,000 bopd

At Dussafu, seismic reprocessing completed, potential for material increase in hydrocarbon volumes at Hibiscus up to three times as large

Material cost and time savings through an alternative development plan for the Hibiscus/Ruche area using jack-up rigs in place of a wellhead platform

$100 million gross in capital savings as compared to previous concept

Break-even for next development phases of approximately $25 per barrel

One crude oil lifting in the third quarter, sold at $46 per barrel with operating costs of $19.6 per barrel

Tunisia

5,000 bopd gross target achieved during October and current production steady at these levels

Tunisian quarterly production of 3,261 bopd gross on average, with production being impacted by replacement of two ESPs

Guebiba 10 side-track successful, confirmed oil in two reservoirs, on production in lower Bireno interval with highly productive Douleb to be produced in the future

Multiple workover activities performed during quarter and continuing into Q4, all completed safely and without incident

Two liftings, one international and one domestic, totalling 104,705 bbls during the quarter

Corporate Highlights

In advanced discussions for a senior secured loan facility for the funding of next phases at Dussafu

Strengthening of team with the addition of Tim O’Hanlon as Senior Advisor to the Board. Tim was a founder member of the Tullow Oil team where he spent many of the last 30 years as Vice President of Africa

Hedging strategy proving effective in period of extremely volatile and low oil prices, realising USD 3.9 million in finance income for the nine months to 30 September 2020

Outlook and Guidance

Three liftings expected in 4Q 2020 (two in Gabon, one in Tunisia), generating 35-40% of annual expected revenue

Hedging position remains strong at approximately 25% of production hedged until end 2021 at USD 55 per barrel

2020 net production guidance of 2,200-2,300 bopd

In Gabon, production from DTM-6H (drilled but not tied in) and DTM-7H (to be drilled) to be brought into production likely during 1H 2021

Production growth activity in Tunisia to continue

Dividend of PetroNor shares to Panoro shareholders (upon completion of sale of Aje)

Completion of farm in to Block 2B South Africa (subject to closing conditions)