United Oil & Gas Provides Final Audited Results for the year 31st December 2022

Brian Larkin, CEO, commented:

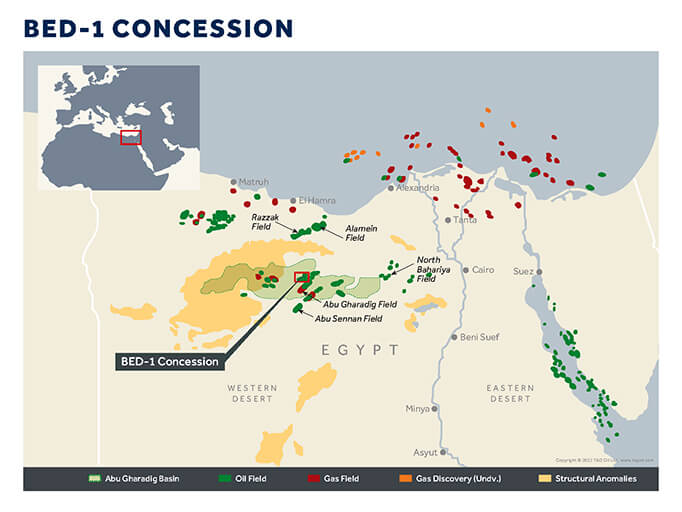

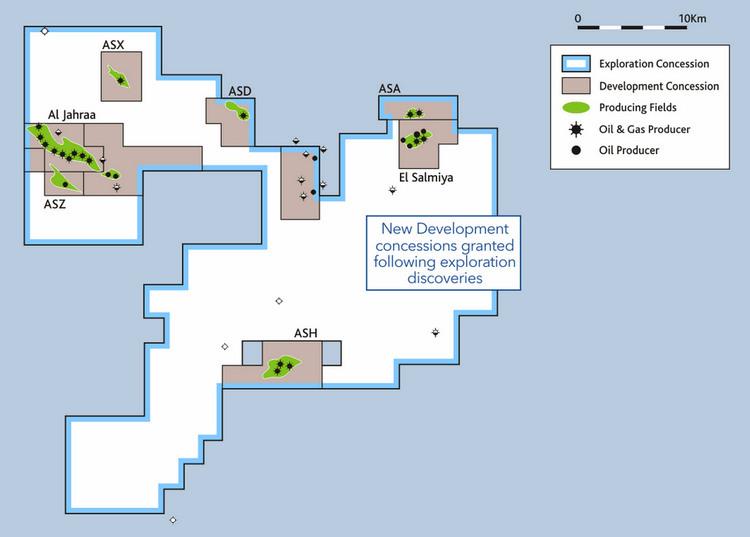

“2022 was filled with extensive corporate and operational activity across our portfolio, all completed with zero LTI’s, TRIR’s and environmental incidents. In Egypt it was a challenging year for United, with five wells drilled and completed in addition to a number of workovers, delivering mixed results following an exceptional 100% drilling success rate during 2020 and 2021. Abu Sennan remains integral to our portfolio and going forward activity on the licence will focus on maintaining and extending long-term production rates to generate operational cashflows for many years to come. In Jamaica, the farm-out efforts of this high impact exploration licence continued with the addition of a new advisor to support the process. In the UK post year-end, an agreement was signed for the conditional sale of the Maria discovery, which is in line with our strategy to actively manage our portfolio.

“Our work programme in Egypt in the first half has started strongly, with a focus on development drilling and workovers. We were delighted with the result of the ASH-8 well which is producing at stable rates and look forward to the results of the ASD-3 well which spud in March. For the remainder of the year, newsflow will centre around the results from our ongoing Egyptian drilling programme, the expected completion of the sale of Maria and further progress on the Jamaica farm-out.

“We remain committed to our growth ambitions with a focus for new ventures in the Greater Mediterranean and North and West African regions, where the Board and management’s experience and relationships can be leveraged. As such, United is well placed to execute our growth strategy, with a continued focus on disciplined capital allocation to generate the best returns for shareholders.“

Operational summary

· Group full-year 2022 production averaged 1,312 boepd net (1,137 bopd oil and 175 boepd gas) in line with revised 2022 guidance of 1,300-1,325 boepd

· 2022 Egypt work programme completed, consisting of three development wells, two exploration wells, and eight workovers

· Safety and the environment: Zero lost time incident frequency rate. No environmental spills, restricted work incidents or medical treatment incidents

· In Jamaica, the completion of additional technical studies that were agreed as part of the licence extension have provided additional positive support to the farm-out process

· 2023 Egypt work programme has commenced positively, with the ASH-8 development coming onstream in March ahead of schedule and above expectations (post period)

· The second well in the 2023 drilling campaign, the ASD-3 development well, spud at the beginning of April 2023 (post period)

Financial summary

· Group revenue for full year 2022 was $15.8m (1) (2021 : $19.2m)

· The average realised oil price per barrel from Egypt achieved was $96.1/bbl ( 2021 : $68.9/bbl)

· Gross Profit of $12.9m (2021 : $12.3m)

· Profit After Tax $2.3m (2021 : $3.6m)

· Cash Collections of $16.9m (2021: $17.3m)

· Group Cash balances as at 31 December 2022 were $1.4m with Net Debt of $1.5m (FY 2021: Cash balances $0.4m, Net Debt $3.9m)

· BP Acquisition facility to be fully repaid in 2023

· Capital expenditure for the year was $8.6m (FY 2021 : $6.9m)

· Egyptian receivables of $4.4m (FY 2021 : $5.1m)

(1)22% working interest net of Government Take