Tullow Oil to raise $300 million to Fund East & West Africa Operations

Tullow Oil has said it will be raising $300 million of Convertible Bonds due 2021 to diversify the company’s sources of funding and the proceeds will be used for general corporate purposes and to fund capital investment in the Group’s assets in West and East Africa.

According to Tullow Oil Chief Financial Officer Ian Springett the bond has strengthened the exploration company liquidity position and will diversify its sources of capital.

“We are very pleased with the result of this bond offer which reflects the confidence that the market has shown in the Group’s business and financing strategy. The high level of demand has enabled us to strengthen our liquidity position and diversify our sources of capital,” said Ian.

The monies are likely to be used to fund ongoing projects such as the early oil pilot scheme EOPS project and appraisal activities in Kenya, entry into the development phase in Uganda with the pipeline already funded by Total

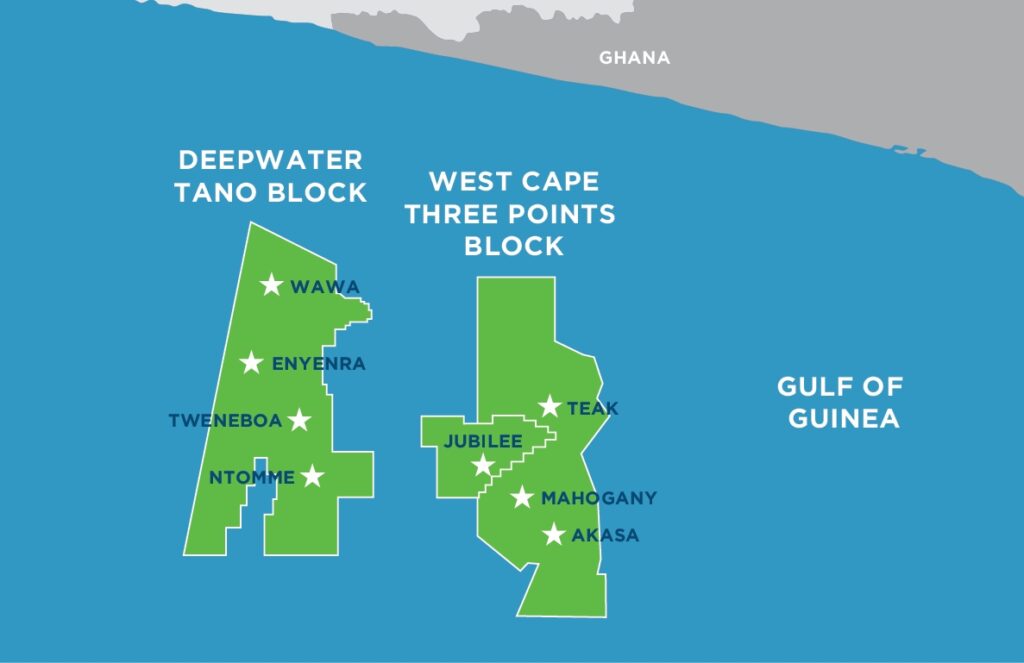

At the Jubilee project in Ghana the company and its partners will be converting the FPSO to a permanently spread moored facility, with offtake through a new deepwater offloading buoy, as the preferred long-term solution.