Tullow Oil Provides Operational Update

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented today:

“I am pleased to report that Tullow has made excellent operational and financial progress in the first half of 2021. Our producing fields in West Africa are performing well and we have successfully started our drilling programme in Ghana. This strong operational performance, combined with continued capital discipline, improved market conditions and asset sales in Gabon and Equatorial Guinea, supported our transformational debt refinancing. Tullow now has a strong financial footing and we are making very good progress in delivering on our highly cash generative business plan and continuing to reduce our debt.”

Operational update

Production

Group working interest production in the first half of 2021 averaged 61,200 bopd, in line with expectations. Full year 2021 guidance has been revised to 55,000 – 61,000 bopd (from 60,000 to 66,000 bopd). The guidance reflects the sales of the Equatorial Guinea assets and the Dussafu Marin permit and first half delivery.

Ghana

- In the first half of 2021, Jubilee gross production was slightly ahead of expectations, averaging 70,600 bopd (net 25,100 bopd). TEN gross production averaged 37,000 bopd (net 17,400 bopd). Combined FPSO uptime was in excess of 98%.

- Improved gas offtake and increased water injection rates in Jubilee have been sustained, averaging between 110-130 mmscf/d and over 200 kbw/d, respectively.

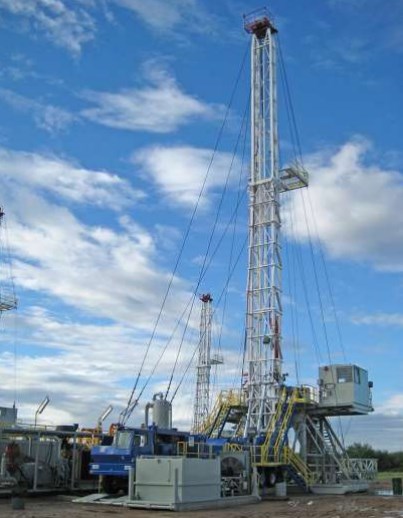

- The 2021 drilling campaign is progressing well. The first Jubilee producer (J-56) is now onstream with encouraging initial flow rates. The well is adding c.10kbopd to the Jubilee field rate, slightly ahead of pre-drill expectations. The rig is now completing a Jubilee water injector (J-55 WI) with tie-in expected in the third quarter of the year.

- The rig will then move on to drill a TEN gas injector and a second Jubilee producer, with tie-in expected in late 2021 and early 2022, respectively.

- As a result of the new wells, average production from Jubilee is expected to increase in the second half of the year before growing further in 2022 as the drilling campaign continues.

Non-operated

- In the first half of 2021, net production from the non-operated portfolio was 18,800 bopd, in line with expectations.

- Following the sale of assets in Equatorial Guinea and the Dussafu Marin permit in Gabon, some capital expenditure has been re-allocated to accelerate the Simba expansion development in Gabon. Development of this low-risk, high-return project is expected to commence in the third quarter of 2021 with a positive impact on 2021/2022 production.

Kenya

- The Kenya project has been through a full redesign using data from the 2018 -2020 Early Oil Pilot Scheme (EOPS) being fed into the model which is providing better understanding of both the resource and the optimum development plan.

- The technical work is complete, and the resource volumes are being audited by Gaffney Cline Associates (GCA) ahead of detailed project plan discussions with the Government of Kenya over the coming months.

- Tullow and its JV Partners expect to provide a project update to the market in the second half of 2021.

Exploration

- In the emerging and maturing basins of Guyana, Suriname, Argentina and Côte d’Ivoire, prospect maturation continues across the exploration portfolio to unlock value from the substantial prospective resources identified.

- Around the Group’s producing assets in Ghana, Côte d’Ivoire and Gabon, the exploration team are maturing several near field and infrastructure-led opportunities as potential future drilling candidates.

- Separately, Tullow has exited Blocks Z38 and Z64 in Peru and PEL 0037 in Namibia.