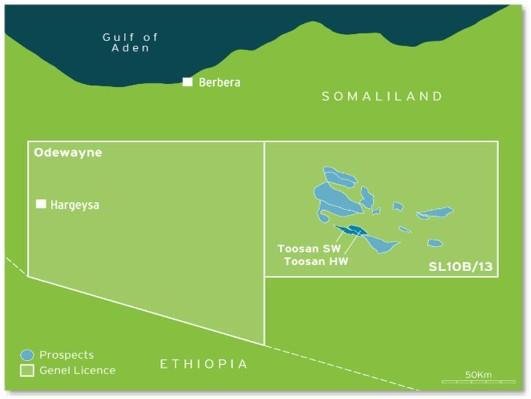

SOMALILAND: OPIC Acquires 49% Working Interest in SL10B13 Block

Genel Energy has announced it has signed a farm-out agreement relating to the SL10B13 block, Somaliland, with OPIC Somaliland Corporation (‘OSC’), with all its share of future capital investment coming from CPC Corporation, Taiwan, the state-owned enterprise of Taiwan. Under the agreement, OSC receives a 49% working interest in the block for a cash consideration of 49% of all Genel’s historic back costs, plus a cash premium. Genel previously held a 100% working interest, and will continue as operator.

Somaliland has significant underexplored potential, with geology analogous to Yemen. The SL10B13 block is highly prospective, with multiple stacked prospects with over 5 billion barrels of prospective resources identified from the interpretation of the 2D seismic data acquisition completed in January 2018.

The field partners will now work together to plan exploration drilling in this block, with an aim of drilling a well in 2023. It is currently estimated that a well can be drilled for a gross cost of c.$40 million. The prospective SL10B13 area is c.150 kilometres from the port at Berbera, offering a route to

international markets.

The agreement has been approved by the Government of Somaliland.

Mike Adams, Technical Director of Genel, said:

“Somaliland is a highly-prospective and largely unexplored region, with a compelling technical case for the drilling of a well. Oil seeps confirm a working petroleum system, and one prospect alone could target over half a billion barrels across multiple stacked reservoirs. Being able to drill this at a low-cost to Genel, with a clear route to market in a success case, fits with our strategy, and we look forward to working with OSC.

During the energy transition the hydrocarbons that should be developed are those that are low-cost, low-carbon, and deliver a material and tangible benefit to local people and the host government. Somaliland has the potential to tick all of those boxes.”