NIGERIA: Africa Oil Announces Favorable Prime RBL Redetermination

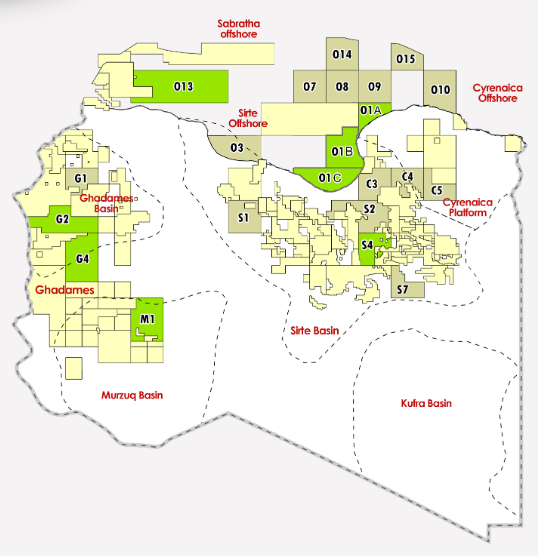

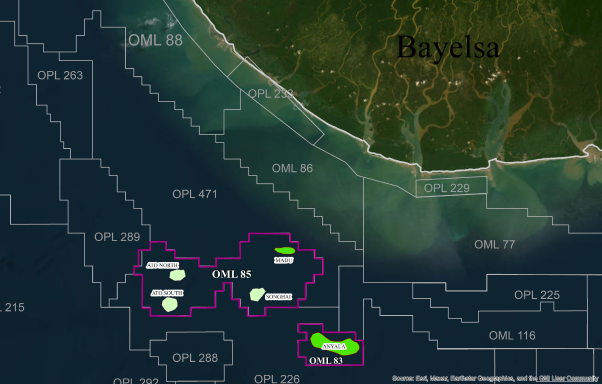

Africa Oil Corp. has provided an update on Prime Oil & Gas B.V. Reserve Base Lending facility (RBL). Africa Oil has a 50% shareholding in Prime, a company with deepwater producing assets offshore Nigeria.

The September redetermination of the Prime RBL has been approved by the banking syndicate with a total principal amortisation for 2020 of US$522 million. This is US$108 million less than management’s initial guidance of US$630 million as announced on February 25th, 2020.

As a result of this outcome and Prime’s large cash surplus, Prime with the support of its shareholders has elected to repay and cancel US$297 million of the RBL principal on September 30th, 2020, which will satisfy the scheduled repayments for the third and fourth quarters of 2020. The early settlement of the fourth quarter repayment will result in US$2 million of savings in interests and fees during the next three months. Prime is not expected to make any further principal repayment until the results of the next RBL redetermination scheduled to be finished on 31st March 2021. The outstanding RBL principal amount now stands at US$1,303 million.

Africa Oil is also pleased to confirm that Prime has sold all three planned oil cargoes in September 2020 for a combined sales volume of approximately 2.8 million barrels (1.4 mmbbl net to Africa Oil’s 50% shareholding in Prime) at an average price of US$60 per barrel. A further three cargoes scheduled for the fourth quarter 2020 (approximately 3.0 mmbbl or 1.5 mmbbl net to Africa Oil’s 50% interest) have been sold forward at an average price of US$61 per barrel, and 7 of 10 cargoes planned for the first half of 2021 (approximately 7.0 mmbbl or 3.5 mmbbl net to Africa Oil’s 50% interest) have been sold forward or hedged at an average price of $60 per barrel.

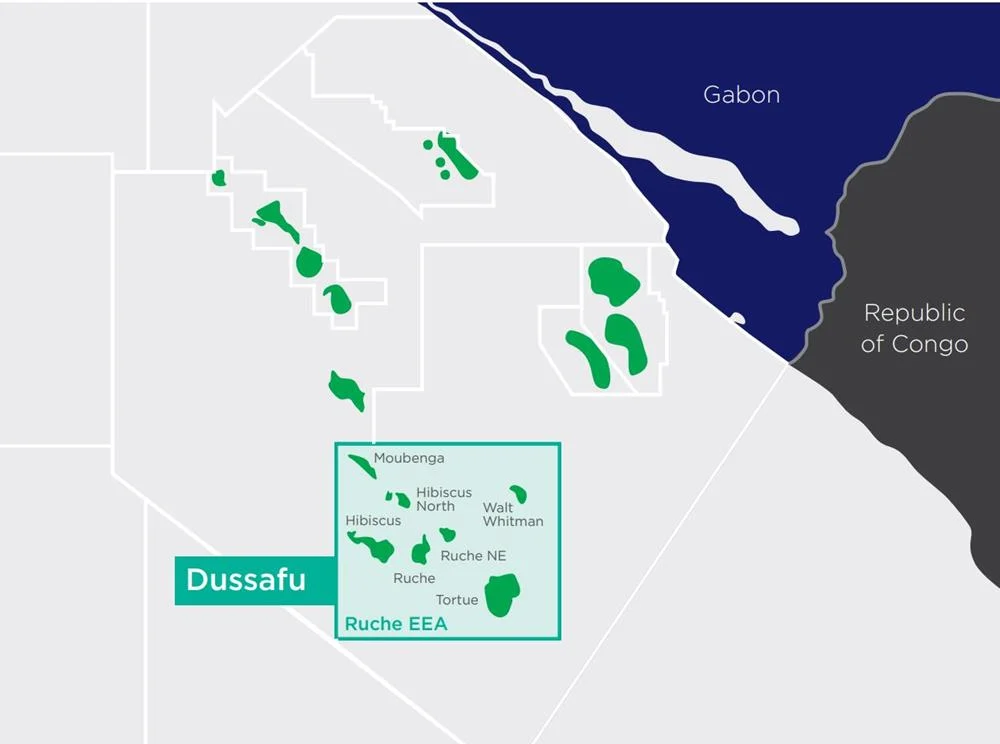

Africa Oil CEO Keith Hill commented, “We are very pleased with the endorsement by the lending banks of our Nigeria deepwater assets. The ability for Prime to repay 29% of its outstanding debt in these difficult market conditions is a testament to the quality of Prime’s low-cost producing assets that are further strengthened by Prime’s industry leading hedging position. Prime’s cash flows provide us with a strong platform to deliver growth and value creation from our portfolio of exploration and development opportunities. Most immediately we are looking forward to the results of the Luiperd well that is currently drilling on Block 11B/12B offshore l nigeria and to which we have significant exposure through our equity investments in Africa Energy and Impact Oil and Gas.”