KENYA: Upstream & Pipeline Revised Plans Drive Costs to $3.4B

The total gross capital expenditure (capex), which covers both the upstream and the pipeline to First Oil, is expected to increase to $3.4 billion as the KJV revised the previous design according to the latest announcement by the operator Tullow Oil.

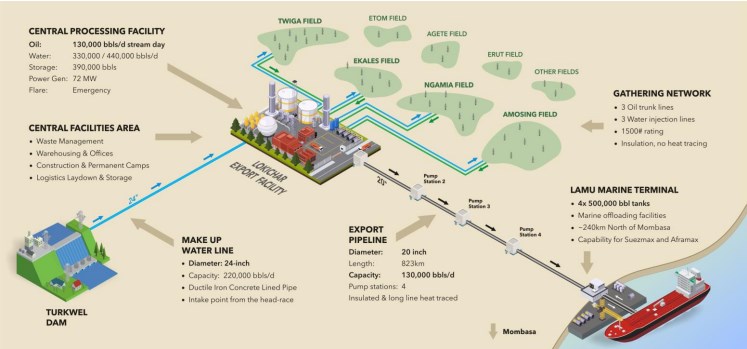

According to the operator the new design to include a bigger facility processing capacity, additional wells to be drilled and a larger diameter crude oil export pipeline, which delivers 30% increase in resources whilst lowering the unit cost to $22/bbl (previously c.$31/bbl).

The revised concept as announced by OilNews Africa last week also allows greater flexibility in adding additional fields into production without significant modifications to the project’s infrastructure.

Over the past year, Tullow says together with Joint Venture (JV) Partners (Africa Oil and Total Energies) have completed the redesign of the Kenya development project (Blocks 10BB and 13T licences) to ensure it is a technically, commercially and environmentally robust project. Other changes as we had earlier revealed include a higher production plateau of 120,000 bopd, with expected gross oil recovery of 585 mmbo over the full life of the field. This resource position is supported by external international auditors Gaffney Cline Associates (GCA) who have issued a Competent Persons Report (CPR) and confirmed the life of field resource position of 585 mmbo.

In today’s announcement the key changes to the development concept have been driven by:

1. Incorporating the production data from the Early Oil Pilot Scheme (EOPS) where 450,000 bbls was produced from Amosing and Ngamia fields. These two fields account for over 50% of the resource distribution, leading to greater confidence in achieving the higher end of the resource distribution range.

2. Optimising the number of wells to be drilled with drilling initially at the crest of the fields to achieve First Oil. Changing the producer to injector ratio from 2:1 to 1:1 leading to improved pressure support and higher resources recovered from the reservoir.

3. Adding the Ekales field into the first phase of production. Ekales is geographically straddled between the Twiga and Amosing fields and ongoing technical work has helped mature our understanding. As such, the first phase will now include the Ngamia, Ekales, Amosing and Twiga (NEAT) fields and will target 390 mmbo of the overall 585 mmbo.

4. Optimising the overall development cost with a facility design capacity of 130,000 bopd and an increase to the pipeline size from 18″ to 20″ to handle the increased flow rates.

On the environmental and social aspects of the project the JV partners have reviewed the carbon emissions will be limited through a combination of heat conservation, use of associated gas for power and reinjection of excess gas into the reservoir.

Tullow says the jv continues to explore opportunities to use the Kenyan national grid that is substantially powered by renewables and options to offset remaining emissions.

The plan remains the same for the 825-kilometres long pipeline that will transport the crude oil from Turkana to the port of Lamu which will be heated and buried to avoid long-term disruption. The project will also require water for reservoir pressure which will be abstracted through a pipeline from the Turkwell Dam and will also be used to provide water to local communities.

Simultaneously to the development, an exploration and appraisal plan will be put in place to ensure the remaining five discoveries are efficiently developed. This will extend and sustain initial plateau rates while keeping costs low by using the rigs used for development drilling. Future phases will also focus on additional exploration potential within the Blocks 10BB and 13T licences and also exploring the wider Blocks 10BA and 12B licence acreage.

Tullow and its JV Partners have submitted a draft FDP to the Ministry of Energy & Petroleum for their review and are now working collaboratively with them and will incorporate their feedback and plan to submit a final FDP by the end of 2021, in line with licence extension requirements provided by the Government of Kenya in December 2020. At the same time Tullow and its JV Partners are actively seeking strategic partners for the project.

Based on the revised plan, Tullow believes that this project is an attractive commercial prospect for investors looking to access the East Africa oil and gas sector in both the upstream and midstream. It is intended that a strategic partner will be secured ahead of a Final Investment Decision.