GABON/EGYPT: VAALCO Energy Provides Operational Update

- Reported fourth quarter 2022 production of approximately 18,175 working interest (“WI”) barrels of oil equivalent (“BOEPD”) or about 14,200 net revenue interest (“NRI”) BOEPD;

- Production was within VAALCO’s fourth quarter 2022 guidance range and was positively impacted by strong Egypt production but offset by delayed Gabon well timing and related lower-than-expected flow rates, as well as weather and operational delays impacting well tie-ins in Canada;

- Production by area for the fourth quarter of 2022:

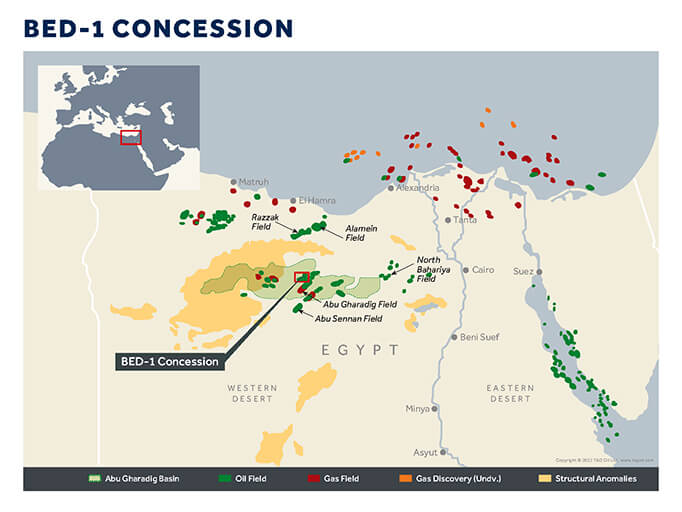

- Egypt: Approximately 8,850 WI BOEPD or 5,975 NRI BOEPD;

- Gabon: Approximately 7,075 WI BOEPD or 6,150 NRI BOEPD;

- Canada: Approximately 2,250 WI BOEPD or 2,075 NRI BOEPD;

- Raised full year 2022 production by 43% year-over-year to approximately 10,150 NRI BOEPD;

- Generated significant cash flow in 2022 that fully funded record capital investment and shareholder returns;

- Fourth quarter 2022 capital spending totaled approximately $55 million (subject to final reconciliation and audit), modestly above the guidance range, primarily due to increased costs in Gabon related to the completion of the Floating, Storage and Offloading vessel (FSO) installation and field reconfiguration project at Etame and completion of the drilling program;

- In Gabon, the North Tchibala 2H-ST is naturally flowing with no produced water at about 250 gross barrels of oil per day and stable reservoir pressure indicating minimal depletion;

- Drilling programs continue in Canada and Egypt in the first quarter of 2023; and

- The first horizontal well in Egypt has been successfully drilled and completion equipment is being mobilized to site.

George Maxwell, Chief Executive Officer, commented, ‘We have continued to execute on our strategic vision focused on sustainable free cash flow generation, solid operational and financial results, and maintaining a strong balance sheet. This vision helps us to maximize our ability to return meaningful value to our shareholders. In 2022, through dividends and share buybacks, we returned over $12 million in cash to our shareholders. As we have indicated in the past, we are now nearly doubling our quarterly dividend to $0.0625 per share, or $0.25 per share annually, from $0.13 per share. Based on where our stock is currently trading, this would give a dividend yield of over 5%, which is compelling in today’s market. This dividend, when coupled with the planned share buyback, would be a yield at the current share price of about 9% to our shareholders in 2023. When this is combined with the capital appreciation we aim to deliver through our operational activity, the result is a strong investment proposition.

We reported solid production results in the fourth quarter of 2022 from a diversified portfolio of assets across three producing countries. We had strong operating results from Egypt that were offset by some tie in delays in Canada and the timing of production following the FSO conversion as well as the lower results from the North Tchibala 2H-ST well in Gabon. The 2H-ST well production is lower than expected as the reservoir’s permeability in this deeper Dentale formation was less than expected. However, the well is flowing naturally, there is no produced water and the pressure data indicates no evidence of depletion. We expect production to remain stable with minimal declines moving forward. While the last two wells in our 2021/2022 drilling program have not performed to our expectations, the overall drilling campaign at Gabon was a success as the initial two wells were highly successful and exceeded our predrill estimates. The program has materially increased production and extended the economic life of the Etame field, thereby fulfilling the primary objectives of this campaign. We forecast the total drilling program at Etame will achieve pay back later in 2023 and have strong overall economics, demonstrating the strong cash flow profile generated from this quality asset.

We are continuing to integrate the TransGlobe (TGA) team and assets into VAALCO. The combination has given us the ability to diversify our production portfolio and increase our cash flow which will continue to be key to our success moving forward. We have also achieved the first tranche of synergies related to the acquisition. We now have a streamlined management team and Board and have captured the savings from delisting TGA and eliminating other related duplicative public company costs. We continue to rationalize our operational and G&A costs in 2023 as we look to attain additional synergies. We plan to review our 2022 financial and operational results in greater detail, as well as provide our outlook for an exciting 2023 with full year and first quarter guidance during our year-end 2022 conference call in March. We have premier assets in Gabon, Egypt and Canada generating strong operational results, which, coupled with continued strong commodity pricing, allow us to generate significant cash flow. We remain focused on adding value through drilling campaigns, complementary acquisitions and returning meaningful cash to our shareholders.’