Eni achieves financial close for Coral South FLNG in Mozambique

Eni, together with its Area 4 Partners, have announced that the Coral South FLNG multi-sourced project financing achieved financial close, for a total amount of US$ 4,675,500,000 split in the following facilities:

- BPI Export Credit Agency Covered Loan

- KEXIM Export Credit Agency Covered Loan

- Ksure Export Credit Agency Covered Loan

- Sace Export Credit Agency Covered Loan

- Sinosure Export Credit Agency Covered Loan

- Commercial Bank Direct Loan

- KEXIM Direct Loan

Coral South FLNG is the first project sanctioned by the Area 4 Partners for the development of the considerable gas resources discovered by Eni and its Partners in the Rovuma Basin offshore Mozambique. It targets the production and monetization of the gas contained in the southern part of the Coral gas reservoir, by means of a floating LNG plant with a capacity of 3.4 MTPA. A Sale and Purchase Agreement was signed in 2016 for the sale of 100% of the LNG production to BP.

Coral South FLNG is the first project sanctioned by the Area 4 Partners for the development of the considerable gas resources discovered by Eni and its Partners in the Rovuma Basin offshore Mozambique.

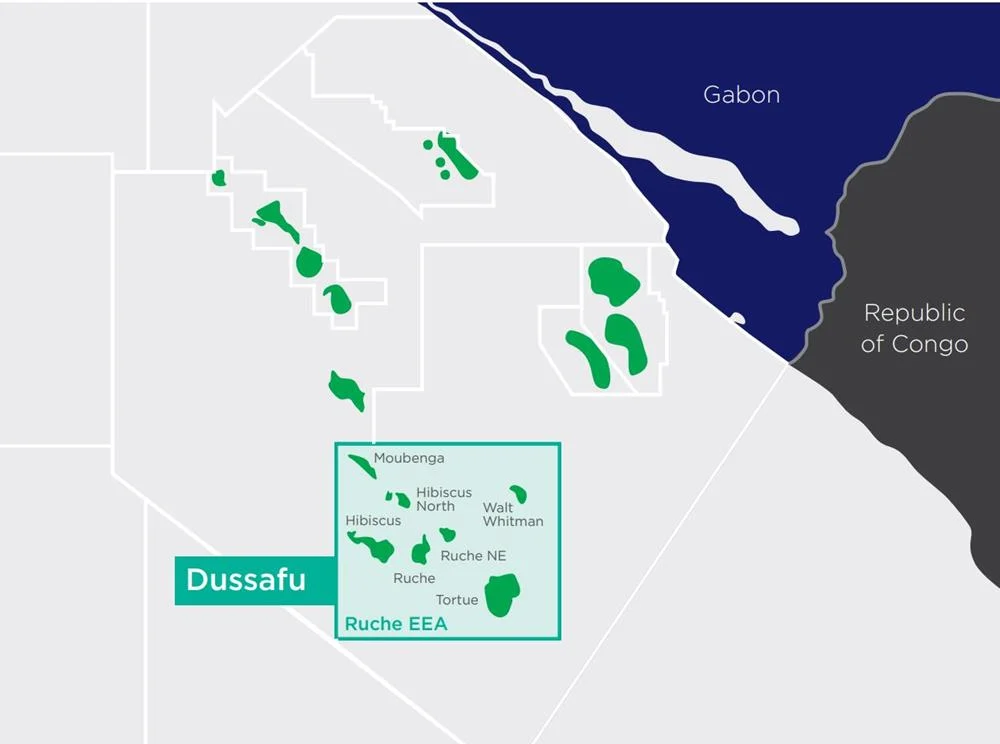

Eni is the Operator of Area 4, holding a 50 percent indirect interest through its participation in Eni East Africa (EEA). In March 2017, Eni and ExxonMobil signed a Sale and Purchase Agreement to enable ExxonMobil to acquire a 25 percent interest in Area 4, through EEA. The remaining interests in Area 4 are held by CNODC (20%), Empresa Nacional de Hidrocarbonetos E.P. (ENH, 10%), Kogas (10%) and Galp Energia (10%).