EGYPT: SDX Energy Spuds MSD-25 infill development well on the Meseda field

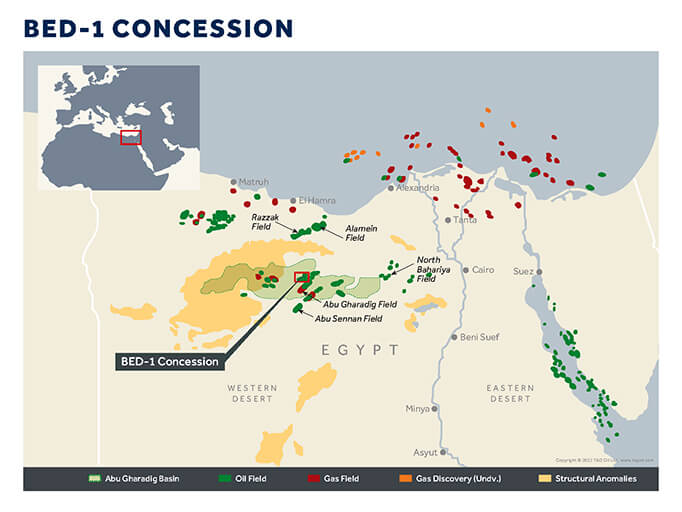

SDX Energy has announced the spudding of the MSD-25 infill development well on the Meseda field. This well is the second in a fully-funded 12 well development campaign on the Meseda and Rabul oil fields in the West Gharib concession, Egyptian Eastern Desert. The development drilling campaign is aimed at growing production from current gross rates of c.2,100bbl/d to c.3,500 – 4,000bbl/d by early 2023.

The MSD-25 infill development well on the Meseda field (SDX:50% working interest) spudded on 23 January and is targeting the Asl Formation reservoir at approximately 3,250ft TVDSS. It is estimated that the well will take around six weeks to drill, complete and tie-in to the existing infrastructure. MSD-25, with an expected gross cost to drill and tie in of US$0.9-US$1.0 million, is anticipated to come on-line and produce at around gross 300bbl/d, which would have an immediate effect on Group cashflow and result in a payback period of less than one year at current oil prices. The Company expects to update the market on its result in late February.

The first well in the campaign, MSD-21, has been tied-in and is on production. MSD-21 is currently cleaning-up and should reach its expected production rate of around gross 300bbl/d in the coming weeks.

Mark Reid, CEO of SDX, commented:

“I am pleased that we have spud MSD-25, the second well in the campaign, so quickly after bringing MSD-21 onto production, which is testament to the efficiency of the operations team in country and bodes well for completing the campaign in a timely manner. West Gharib is a very high margin asset in our portfolio with a netback of US$35/bbl at US$68/bbl Brent in the first nine months of 2021. Given this, it is our intention to execute this twelve well campaign as quickly as possible and thus significantly boost production and cashflow from these fields. I look forward to updating the market further as the campaign progresses.”