SOUTH AFRICA/NAMIBIA:Eco Atlantic Receives TSXV Approval for the Closing of the Azinam Acquisition

Eco (Atlantic) Oil & Gas has confirmed that it and Azinam Holdings Limited have now received final approval from the TSX Venture Exchange for Eco’s acquisition (through a wholly-owned subsidiary) of Azinam Group Limited, and accordingly Eco is now the sole owner of Azinam and will now issue 22,296,300 new Common Shares in Eco (“Common Shares”) to Azinam Holdings representing 9.9% of the Enlarged Share Capital detailed below (the “First Tranche”), with the issuance of the remaining 17,874,174 Common Shares, subject only to Exchange clearance of the Personal Information Forms (“PIFs”) of Azinam Holdings’ Directors, which is expected to be received this week. A further announcement confirming the issue of the Second Tranche will be released once the Exchange confirmation has been received.

As disclosed in the Company’s announcement of February 8, 2022, the Acquisition will result in the issuance to Azinam Holdings of, in aggregate, 40,170,474 Common Shares (the “New Issue”), providing Azinam Holdings with 16.5% of Eco’s share capital as enlarged by such issue, providing for a cashless acquisition to become the sole owner of Azinam’s entire African portfolio. In addition, the Company expects to receive customary formal acknowledgment from the government of South Africa in respect of this change of control shortly.

At no time will Azinam Holdings be entitled to subscribe for and purchase such amount of Common Shares which, when aggregated with its already existing ownership of Common Shares, would result in Azinam Holdings being the registered or beneficial holder of more than 19.9% of the then issued and outstanding Common Shares, without the prior written consent of the Exchange and Eco and in accordance with the policies of the Exchange. Eco has agreed that, for as long as Azinam Holdings holds at least a 12.5% interest in Eco’s share capital, Azinam Holdings shall be entitled to nominate one director for election to Eco’s board of directors.

Admission of the Consideration Shares

Application has been made for admission of the First Tranche, which will rank pari passu with existing Common Shares, to trading on AIM (“Admission”). It is expected that Admission will become effective and trading will commence at 8.00 a.m. on 31 March 2022.

Following Admission of the First Tranche, the enlarged issued share capital of the Company will be 224,989,935 Common Shares. The above figure may be used by shareholders as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the share capital of the Company.

Gil Holzman Co-Founder and CEO of Eco Atlantic commented:

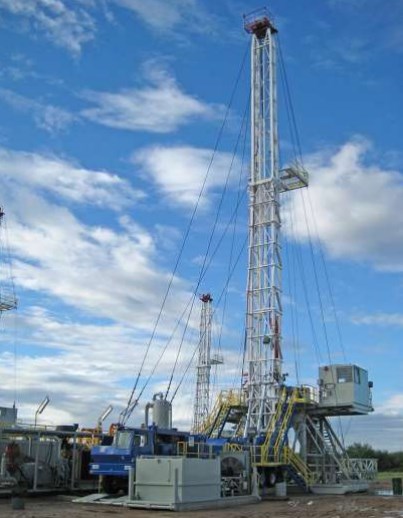

“We are happy to now officially own Azinam Group Ltd. and its subsidiaries. We now look forward to operating a number of highly prospective licences in three exploration hotspots: Guyana, Namibia and South Africa. We continue to make strong progress towards the upcoming drilling of the Gazania-1 well on Block 2B, offshore South Africa, and following the signing of the rig contract earlier in the month we anticipate drilling to commence in late Q3 2022. We look forward to receiving the final formal acknowledgement from the South African government for the change of control entities and to making further updates on our strategic acreage in due course.”