Africa Oil 2020 Net Income Hits $118M

- Africa Oil has received an additional $50 million in dividends from Prime subsequent to the previous reporting period. This brings the total dividends amount to $162.5 million since Africa Oil closed the Prime acquisition on January 14, 2020.

- Significant progress on deleveraging, including a 34% reduction in the corporate term loan from $250 million to $164.8 million, and a 29% reduction in the Prime RBL facility from $1,825 million to $1,303 million, for the year to date.

- Africa Oil third quarter net income of $21.2 million and nine-month net income of $118.1 million, excluding a $215.6 million non-cash impairment of Kenya exploration assets posted in the first quarter 2020.

- Selected Prime’s third quarter 2020 results net to Africa Oil’s 50% shareholding*:

-

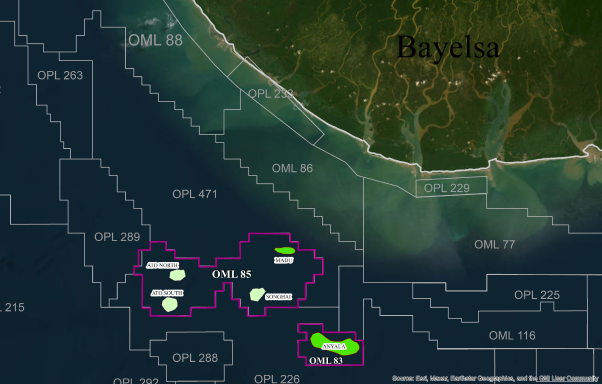

- average daily working interest (“W.I.”) production of 26.9 thousand barrels of oil equivalent per day (“kboepd”) and economic entitlement production4 of 27.8 kboepd with 83% in oil production (nine-month period: W.I. production of 29.5 kboepd and economic entitlement production of 35.3 kboepd with 85% in oil production);

- sales revenues of $212.5 million (nine-month period: $551.2 million);

- adjusted EBITDA5 of $99.0 million (nine-month period: $490.3 million); and

- cash flow from operations of $107.5 million (nine-month period: $438.0 million).

- Exploration success continued with the Luiperd discovery on Block 11B/12B, offshore South Africa and the farmout of Transkei/Algoa blocks to Shell.

Africa Oil President and CEO Keith Hill commented: “I am pleased to report another strong quarter with a profit of $21.2 million. Despite these challenging times, our Nigerian assets continue to perform well, and we continue to deleverage despite the OPEC+ cuts imposed on the Egina field. During 2020 we have repaid 34% of our BTG term loan and Prime has reduced its RBL facility by 29%.

We have also achieved another significant exploration success on Block 11B/12B, offshore South Africa, with the giant Luiperd discovery. I am delighted that the operator believes that together with last year’s Brulpadda discovery, there is sufficient ground to move the project towards development. I am also confident there is substantial follow-on exploration potential on this world-class block, that complements the development opportunity of the two discoveries.

We are also very pleased that Impact Oil and Gas has expanded its portfolio and attracted a high-quality partner in Royal Dutch Shell to its Transkei and Algoa license, offshore South Africa. Through our shareholding in Africa Energy, Impact and Eco Atlantic, we have interests in an industry leading acreage position in an exciting region extending offshore Namibia and South Africa. We are now looking forward to the spud of Venus exploration well on Block 2913B, in Namibia’s Orange Basin in the first half of 2021, which will target one of the largest submarine fans ever tested by the industry.

Meanwhile Chief Operating Officer, Tim Thomashas elected to retire at the end of first quarter 2021.